Modifications to the Mexican Transfer Pricing Miscellaneous Tax Rules

In the following link, it is available a comparative analysis of the changes to the rules 3.9.1.3., 3.9.11 y 3.9.15 on regards of transfer pricing adjustments, and submission of transfer pricing returns requested by the Article 76-A of the Mexican Income Tax Law, as provided by the 1st resolution of amendments to the 2019 Miscellaneous Tax Rules. :

Comparative analysis. Changes to rules 3.0.1.3, 3.9.11, and 3.9.15 regarding transfer pricing in the 1st resolution of amendments to the Miscellaneous Tax Resolution for 2019

In the first Motion of Changes to the Miscellaneous Tax Resolution for 2019 we find various changes to the rules as they apply to Transfer Pricing as highlighted in the following:

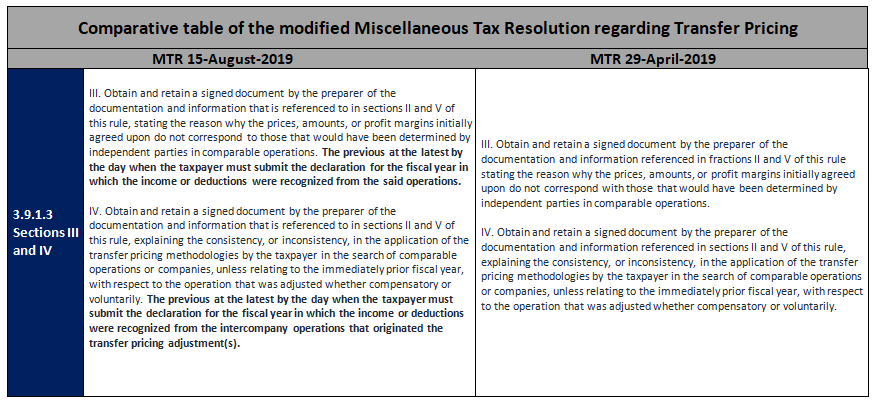

3.9.1.3. Sections III and IV

Transfer pricing deductions in the fiscal year in which they were recognized as income or deductions derived from the intercompany operations that originated them.

Comments; The date to present adjustments to the deductions originated by the intercompany operations is added to the rule and indicates that these must be presented to the tax authorities at the latest in the declaration of the fiscal year in which these transactions were carried out; whereby there is certainty to the deadline when to present these deductions, as well as their validity for tax purposes.

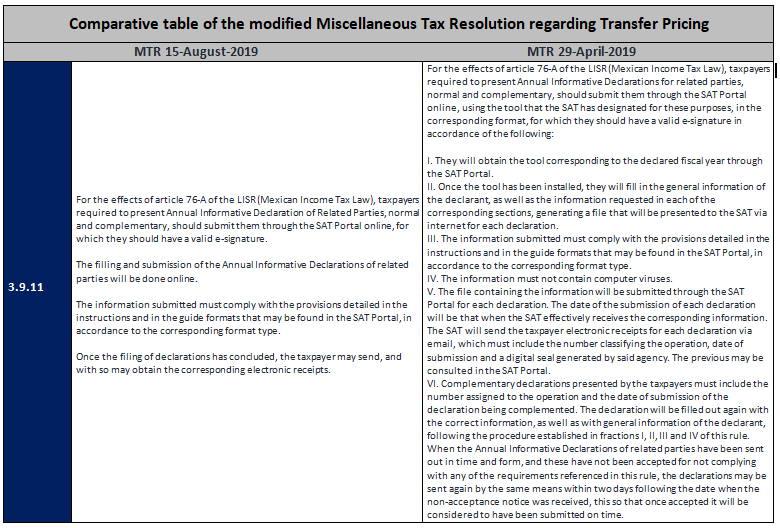

3.9.11.

Requirements to present the Annual Informative Declarations of Related Parties

Comments: This rule underwent drastic changes as, in comparison to the penultimate MTR published by the Diario Oficial de la Federación (DOF or Mexican Official Gazette) Monday 29 April of the present year, the new provision streamlines the rule, eliminating previous clarifications regarding the use of tools to submit declarations and the provisions relative to the submission of complimentary declarations, for which it will be necessary to clarify the current intention of the norm with the authorities.

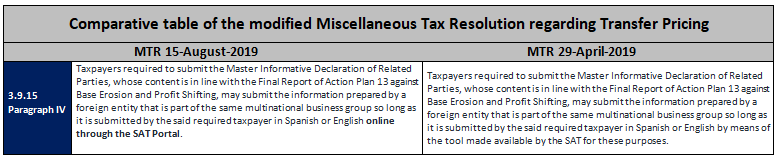

3.9.15. Paragraph IV

Information for purposes of the Master Annual Informative Declaration of Related Parties in the multinational business group

Comments: In this rule we find a slight change which is in line with the aforementioned rule relating to the submission requirements for the annual declarations of related parties which will be submitted online in the SAT Portal.