IRS-SAT renew the Qualified Maquiladora Approach Agreement for the second time

For the second time, the Mexican tax authority, Servicio de Administración Tributaria (SAT) and the Internal Revenue Service (IRS) of the United States of America have renewed the Qualified Maquiladora Approach (QMA) Agreement, with the goal to avoid double taxation for U.S. taxpayers with maquila operations in Mexico and for maquila companies in Mexico to ensure proper taxation by obtaining an Advance Pricing Agreement (APA) in accordance with Article 34-A of the Federal Fiscal Code (CFF) and Article 182 of the Income Tax Law.

In order to uphold the arm’s length principle, the Qualified Maquiladora Approach will apply to obtaining pending unilateral APA resolutions for the fiscal years 2020 to date, in terms of Article 34-A of the CFF, with the General Administration of Large Taxpayers (AGGC) of the SAT, under the terms agreed upon by both tax authorities.

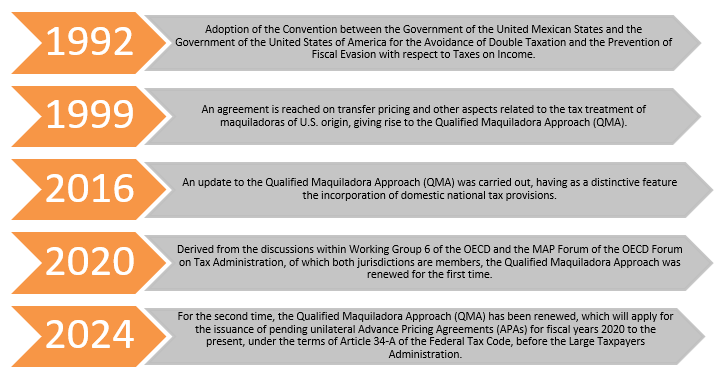

The following is a brief overview of the background of the Qualified Maquiladora Approach:

Access to the methodology for the issuance of APAs for maquiladora companies in Mexico at the following link.