Location impact on profit margins: developed countries vs emerging countries.

In transfer pricing practice is normal that we cannot always find functionally comparable companies located in the same country where analyzed company is, reason why foreign comparable companies are commonly used. According to this, OECD have persistently suggested to apply additional adjustments to include structural differences between comparable companies and analyzed company such as the legal and fiscal framework, human capital, natural resources, geographic location, etc.

However, it is of interest to find out if there actually are significant differences in the profit margins of companies in relation to its location. Such that if this does not occur it would not be necessary to apply any additional adjustment in transfer pricing analysis based on comparable companies country location.

The following present certain relevant points to continue this discussion, followed by a model proposed to evaluate whether a company’s resident country ought be considered as a sufficiently relevant variable to such an extent that a country risk adjustment would be required in the transfer pricing analysis.

Risk-return tradeoff.

The risk-return tradeoff hypothesis considers there is a positive relationship between expected return and risk in an asset; this is because an investor would be willing to invest in a riskier asset than another only if he considers this asset expected return is higher than a return of a less risky asset.

It should be noted that risk, in quantitative terms, is not an observable variable, hence there is a wide variety of models that have been formulated and used daily to try to measure assets risk; which should remind us of the considerable difficulty to measure the risk-return ratio in an empirical analysis such that risk is a condition that cannot be perceived in a completely subjective way by economic agents unlike returns resulted by assets.

Developed vs emerging

Another analysis topic explored in recent years is the contrast between developed and emerging markets, research arises to find out if there are differences in returns obtained in developed countries and emerging countries. The main reason why it is important to make this distinction is that emerging countries are characterized by having a series of social, economic and institutional conditions that results in emerging countries being considered as riskier destinations for investment compared to developed ones.

As emerging countries may be structurally riskier than developed ones, the tradeoff hypothesis would lead us to state that, in terms of this risk compensation, emerging countries would have to offer higher returns than those obtained in developed economies.

Adjustment by country in comparable analysis

The implications of the points discussed above may have in transfer pricing analyses consist on the fundamental differences that may exist in profit margins between similar companies as a result of facing different risks when being located in different countries. This could mean it is necessary to make an adjustment due to differences in risks assumed by a company operating in another country when the analysis seeks to integrate it as a comparable company.

Dataset

Dataset was built with TP Catalyst data and is described as follows (March 2019 updated): Active companies, companies with 2018 accounts, publicly traded companies, companies with a web page, companies with available net cost plus data, companies with available operating margin data and companies located in developed and emerging countries.

Developed countries group includes: Australia, Austria, Germany, Belgium, Canada, South Korea, Denmark, Spain, United States, Finland, France, Ireland, Italy, Japan, Norway, New Zealand, Portugal, United Kingdom, Singapore, Sweden and Switzerland

Emerging countries group includes: Brazil, Chile, China, Colombia, Egypt, Philippines, Greece, Hungary, India, Indonesia, Malaysia, Morocco, Mexico, Peru, Poland, Russia, South Africa, Thailand, Taiwan and Turkey.

The search criteria yielded a set of 7,609 companies.

As the goal is to evaluate the difference in profit margins between companies in emerging countries with respect to developed countries in each industry, companies are classified by major group based on SIC US code. This is because, on one hand, we classify the companies according to the industry they belong and at same time we don’t lose too many observations for each analyzed group.

This classification corresponds to first two digits from US SIC code (which has a total of 99 groups), only sub-industries with 10 observations of companies at least in emerging countries and developed respectively are included resulting in 45 sub-industries to evaluate and reducing sample used from 7,609 to 7,065 companies.

In addition, analysis will be carried out based on two different relationships which are: Net cost plus and operating margin.

Kolmogorov-Smirnov test.

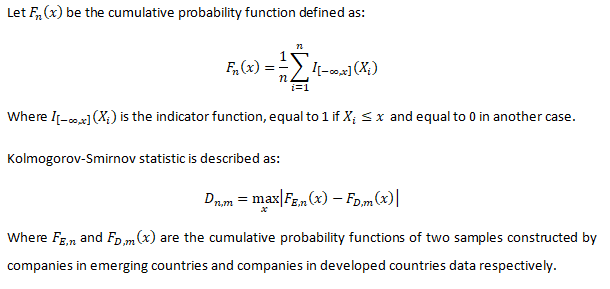

Summarizing what we have reviewed before, we are interested in evaluating whether profit margins of companies in emerging countries differ significantly from margins reached in developed countries. In this case, Kolmogorov-Smirnov test is performed to find out if margin probability distribution in both groups is different for each sub-industry.

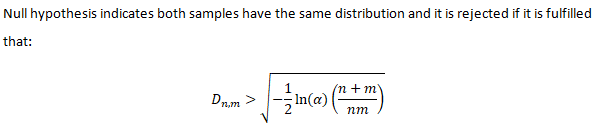

Where α corresponds to confidence level (1- ) %.

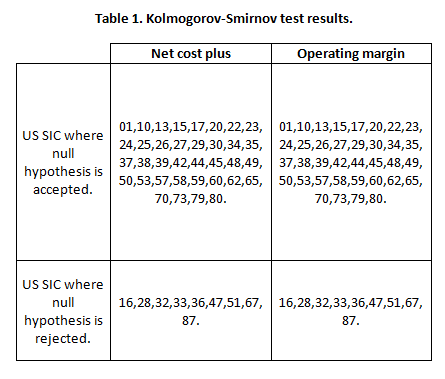

Table 1 shows results from Catalyst database where we can find, in the case of both ratios, only in 9 of the 45 sub-industries analyzed it is reported null hypothesis from Kolmogorv-Smirnov test is rejected. That is, only in 20% of cases studied we could consider there is a difference between margin distribution functions.

Anova model.

In addition to the results shown in previous section, it is also appropriate to discover if differences between distributions are accorded to theoretical sense assumed when making a country risk adjustment.

As we have seen previously, in theory, emerging countries pay higher risk premiums than developed ones. Therefore, if these assumptions are met, company profit margins in emerging countries should be higher than those in developed countries.

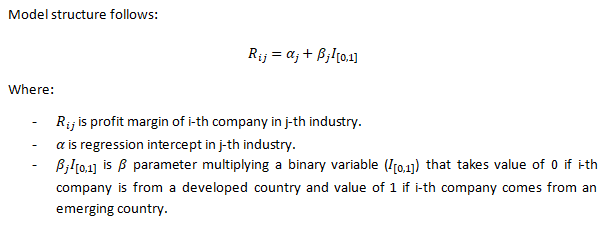

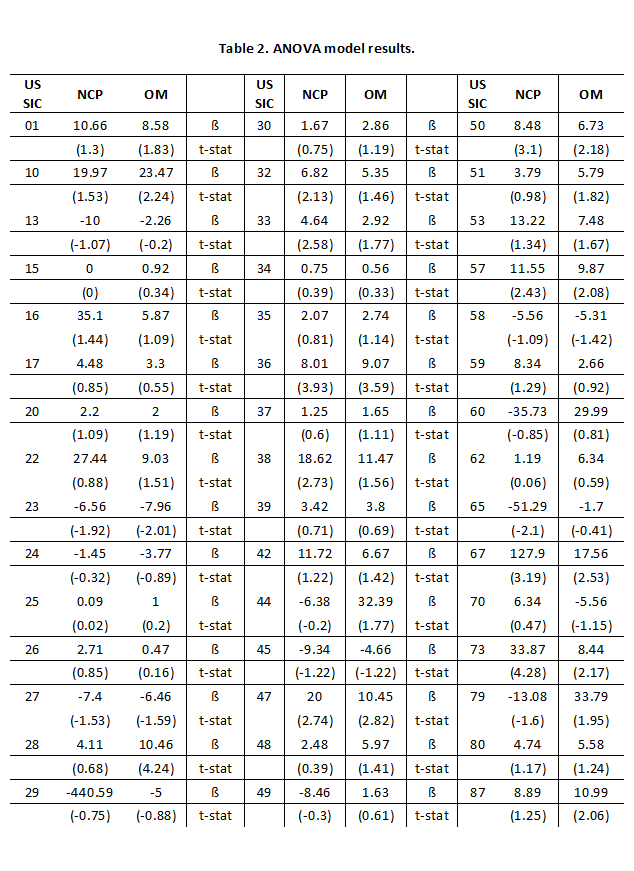

Thus, we use the following ANOVA model to assess whether companies profit margins in emerging markets turn out to be consistently higher than those of companies located in developed markets.

Model takes companies located in developed countries as Benchmark. Therefore, parameter β captures whether there is a difference between profit margins recorded by companies in emerging countries with respect to companies in developed countries in the j-th industry.

Table 2 shows the results of the model for each sub-industry, where it can be considered in the case of net cost plus that in only 11 cases the result of the model indicates a difference statistically significant difference between company ratio value in an emerging and a developed country, which in 9 cases it is indicated ratio would be higher in emerging compared to developed countries.

On the other hand, in the case of operating margin we find a very similar situation, as in net cost plus we have only 11 cases where there is a statistically significant difference in ratio value depending on company location (in emerging or developed country) while in 10 of these cases indicates operating margin ratio is higher if company is in an emerging country in relation to being in a developed country.

In general, these results are quite similar to Kolmogorov-Smirnov test, only in about one fifth of cases analyzed where there is an incidence of company site on ratios used.

Although it should also be noted that in cases where location impact was found the results are consistent with what was expected when reviewing literature (risk-return tradeoff). That is, margin values would be higher in emerging countries compared to developed countries.

Conclusion

That said, we can point out that there is no strong statistical evidence that allows us to accept there is a structural difference between developed and emerging countries that results in higher profit margins of a company because it is sited in an emerging country in comparison of being located in a developed country since in a considerable majority of cases no significant effect of this variable was observed.

For transfer pricing purposes, perhaps we could reconsider the advisability of establishing a country risk adjustment as a standard practice. Given the results obtained, it could happen that when we carry out a previous work of selection of comparable in functional terms, making a country risk adjustment in an additional way may not be correct in a general sense such that this effect seems to be annulled.

The opinions expressed in this article are general in nature and should not be used for the analysis of specific cases without first consulting our firm.

Author: José Chamorro